Coe 3 Months Moving Average

B Select Moving Average. You will notice that the long moving average lags behind the price it always goes in the same direction as the.

You can change the number of months if you want.

Coe 3 months moving average. Put your Value over time. The price jump is due to the 30 reduction of Cat D quotas in 2014 and the panic buying ahead of the Euro III emission standards. Price of paper has tripled in 2 years.

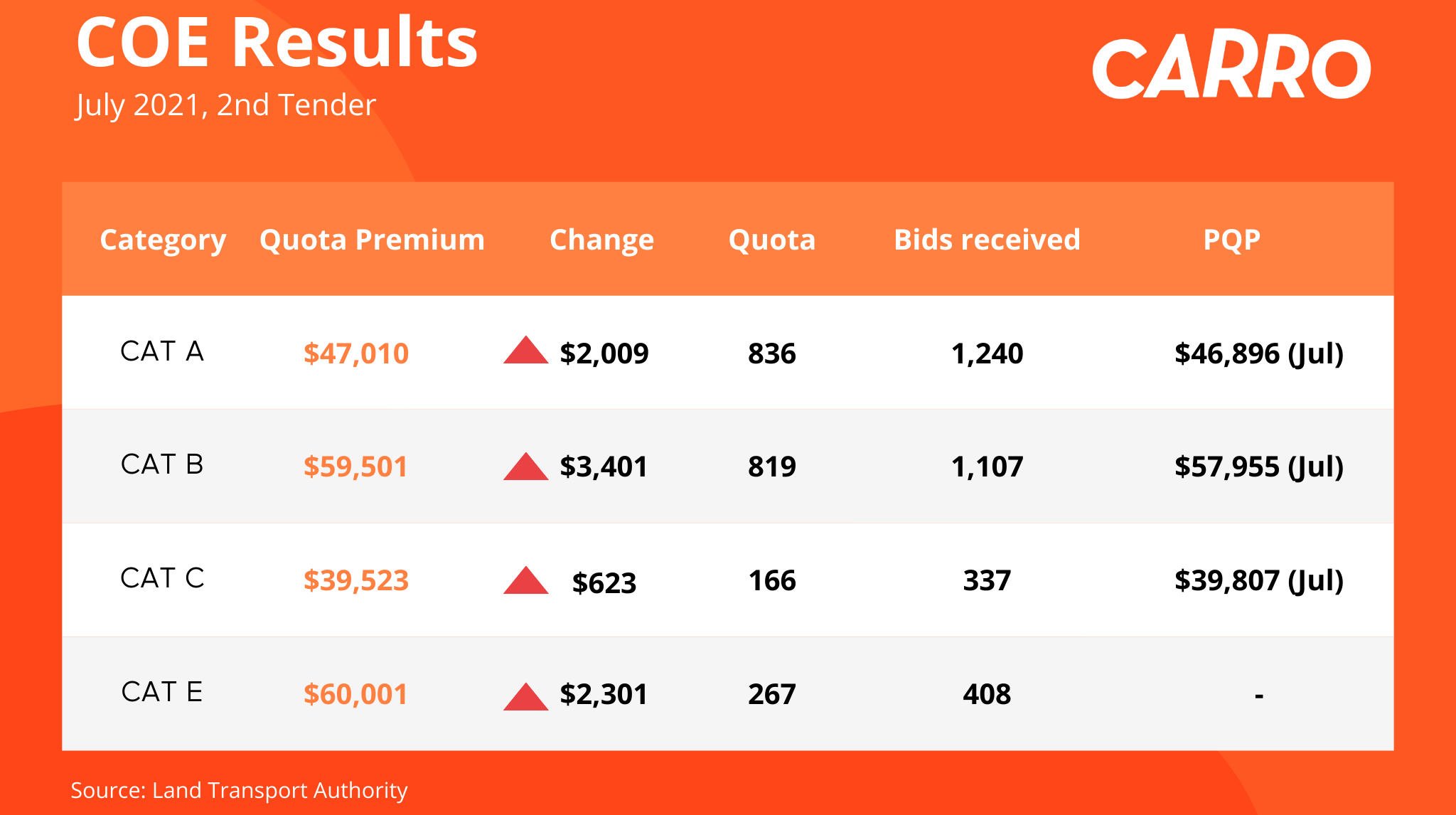

And this results in something like. You can find out the PQP for each month once the 2nd bidding exercise in the previous month is over. COEs renewed for five years will not be eligible for another renewal and will have to be deregistered after expiring.

Attached is a workbook an an example. Because we set the interval to 6 the moving average is the average of the previous 5 data points and the current data point. WITH MEMBER MeasuresSalesAmount 3m average AS SUM DateDateCurrentMemberLag90.

DateDateCurrentMemberLag1 MeasuresSalesAmount I guess I need to use Ancestor function to get month and use lag to. Buy and holds 548 per year this does not include dividends reinvested. 903 870 882 3 885.

Moving_Average_3_Months CALCULATE AVERAGEX Session Session Sessions DATESINPERIOD Session FullDate LASTDATE Session FullDate -3 MONTH Drag the Line Chart into your canvas as below. January 8 1300 and January 7 1320. So the 3 point moving averages are 926 904 885 and 854.

PQP is the moving average of COE prices over the past 3 months. As a result peaks and valleys are smoothed out. Chart Tools tab appears in ribbon.

Following is an example of 3 periods moving average. Under Chart Tools Click on Layout - Trendline - More Trendline Options as shown below. Otherwise there is no limit to the number of times for renewal.

The moving average is also known as rolling mean and is calculated by averaging data of the time series within k. The 4 th 3 point moving average is. SummyValue AvgmyValue OVER LastPeriods3AxisX In the Combination Chart Properties Series page change the moving average series to a Line like this.

3 Months moving average. The moving average is commonly used with time series to smooth random short-term variations and to highlight other components trend season or cycle present in your data. A Click on Chart.

As you need to get the series moving averages of the last 3 months therefore you need to enter the cell references of first three cells in the AVERAGE function in the third adjacent cell of monthly sales data like in cell C4 and drag or copy it down as shown below. On the contrary a long period moving average eg. Then select moving calculation and configure how you want it to be calculated.

200 will often divert far from the price and stay away for extended periods of time. Create a measure for 3 months moving average. 10 will track the price closely almost all the time.

Here is the code for the 3-months average. IF HASONEVALUE Calender Month 3 Month Rolling Average SUMX VALUES Calender Month 3 Month Rolling Average Here is a video explaining the approach for the measure. For January 9 2020 the three-day moving average is calculated as the mean of prices from that day 1300 and the two previous days.

Excel cannot calculate the moving average for the first 5 data points because there are not enough previous data points. Assume that there is a demand for a product and it is observed for 12 months 1 Year and you need to find moving averages for. 939 903 870 3 904.

Right click your measure pill and select add table calculation. In comparison the average price of motorcycle COEs was just 1757 in 2013 and 4027 in 2014. The 3 rd 3 point moving average is.

Set the Period as 3. For the SP 500 1928-2019. Thus the periods over which the average is calculated changes or moves with each ensuing period.

Bill Benton Member Edited by Tableau Community May 8 2020 at 648 PM. Firstly decide on the number of the period for the moving average such as 2-day moving average 5-day moving average etc. Simple Moving Average SMA First lets create dummy time series data and try implementing SMA using just Python.

Hi Maurice Langlois Try this measure. It varies monthly depending on the COE prices of the bidding exercises in the last 3 months. The following chart demonstrates every simple moving average and its.

Since the moving averages are decreasing then the sales figures are going down as the months go by. CALCULATIONITEM PriceToUseMoving AverageRolling Avg 3M VAR NumOfMonths 3 VAR LastCurrentDate MAX DateDate VAR Period DATESINPERIOD DateDate LastCurrentDate - NumOfMonths MONTH VAR Result CALCULATE AVERAGEX VALUES DateCalendar Year Month SELECTEDMEASURE Period. Add 3 months moving average in Excel To do it in Excel here is the answer.

The optimal simple moving average was the 3 day simple moving average which yielded an average of 943 per year vs. The formula for simple moving average can be derived by using the following steps. On a graph would the first moving average be plotted.

The graph shows an increasing trend. Add a new series on the y-axis that does the moving average so your y-axis expression will now be. A short period moving average eg.

PQP is the moving average of COE prices in the last 3 months. Based on a 4-day exponential moving average the stock price is expected to be 3150 on the 13 th day. 870 882 810 3 854.

So the moving average for January 9 2020 is the average of these three values or.

Land Free Full Text Land Use Change And Farmers Sense Of Place In Typical Catchment Of The Loess Hilly And Gully Region Of China Html

Calculate A Year To Date Ytd Monthly Moving Average In Power Bi Enterprise Dna

Chapter 2 R Basics Introduction To Data Science

Latest Coe Prices And Bidding Results 2021 Motorist

Coe Expiring Here S What To Do Next Carro Blog

Posting Komentar untuk "Coe 3 Months Moving Average"