What Are The Quantitative Forecasting Techniques Explain Each

Following are the important quantitative techniques used for the purpose of forecasting- ADVERTISEMENTS. As these projections are based on clear numerical information and statistical techniques this method eliminates the risk of bias while producing clearer results.

Classification Of Forecasting Techniques Download Table

What Is Quantitative Forecasting.

What are the quantitative forecasting techniques explain each. Examples include analysis of daily stock prices weekly sales goals and monthly expenses. Makes use of Forecasting Techniques. Having determined the deviations of the actual performances from the positions forecast by the managers it will be necessary to examine the procedures adopted for the purpose so that improvements can be made in the method of forecasting.

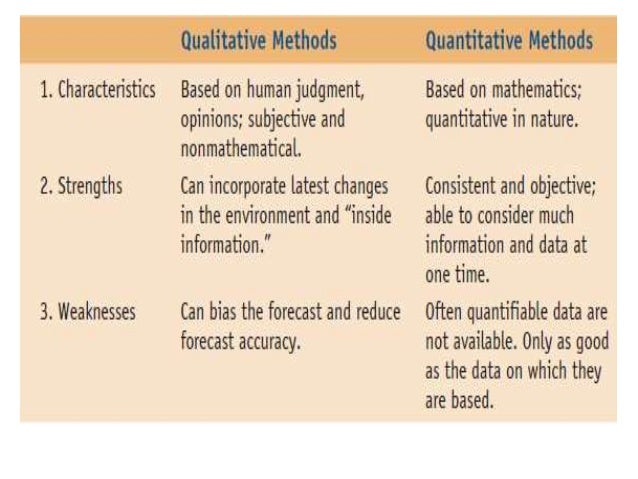

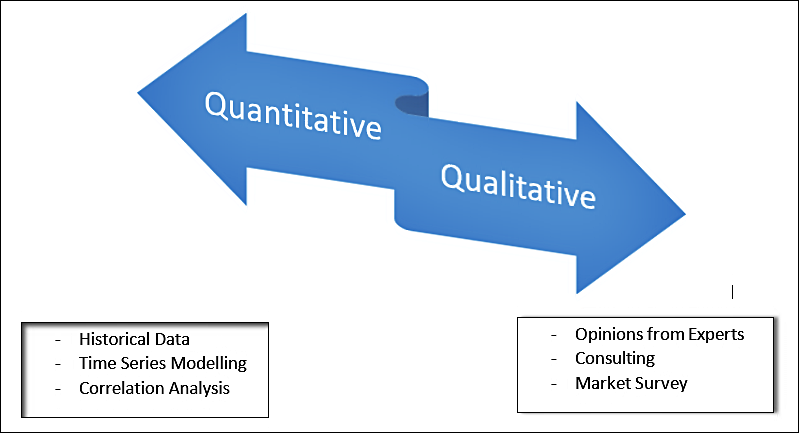

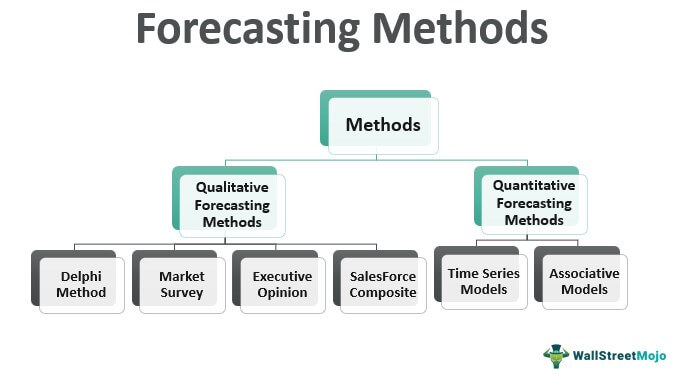

There are mainly two types of forecasting techniques. These types of forecasting methods are based on judgments opinions intuition emotions or personal experiences and are subjective in nature. Quantitative Demand Forecasting Quantitative demand forecasting techniques on the other hand utilize concrete information regarding sales inventory and labor based on the companys historical data.

The widely used qualitative methods are. Such a probing obviously demands a proper and full analysis of known facts with the help of various qualitative and quantitative forecasting techniques. 4 important methods of Qualitative forecasting techniques.

Qualitative forecasts rely on projections that include intuition experience and feedback from external stakeholders such as suppliers and customers. Quantitative forecasting relies on data that can be measured and manipulated. These techniques are primarily based upon judgment and intuition and especially when sufficient information and data is not available so that complex quantitative techniques cannot be used.

It is often used in executive opinion market surveys and the delphi method. This approach is substantially different from quantitative forecasting where historical data is. Qualitative forecasting is made based on judgment of factors other than data.

Qualitative forecasting is an estimation methodology that uses expert judgment rather than numerical analysis. They are highly dependent on mathematical calculations. The basic idea of time-series analysis is to fit a trend line to past data and then to extrapolate this trend line into the future.

A Jury of executive opinion. Models that can incorporate some randomness and non-linear effects. I Business Barometers Method ii Trend Analysis Method iii Extrapolation Method iv Regression Analysis Method v Economic Input Output Model Method vi Econometric Model vii Expectation of Consumer viii Input and Output Analysis.

Quantitative Forecasting Time Series. They are typically used when data is unavailable or there is an unknown pattern change. One can make good use of qualitative method especially when data are sparse for quantitative analysis.

Models that use statistical techniques to establish relationships between various items and demand Simulation. The quantitative forecasting technique is defined as the process of conducting forecasting on the basis of numerical data derived from the companys history Fleischmann et al 2012. As can be gathered from what has gone before that forecasting is a systematic attempt to probe the future with a view to drawing certain useful inferness.

The data is usually from the past. Quantitative forecasting techniques will sometimes call for analyzing time series. It is a statistical technique to make predictions about the future which uses numerical measures and prior effects to predict future events.

Quantitative forecasting is one way you can effectively assess your business by using collected data to make educated inferences about potential future opportunities. This technique forecasts future demand based on what has happened in the past. These techniques examine the underlying context of data over a large period of time.

A time series is an observation of data at different points in time. Quantitative or statistical forecasting should use data on past sales or performance to evaluate if sales are currently increasing or decreasing or the business is flourishing or stagnatingand exactly how quickly this is happening. They do not rely on any rigorous mathematical computations.

Time series model and associative model. Models that predict future demand based on past history trends Causal Relationship. Quantitative Forecasting Techniques Quantitative forecasting methods rely on numbers rather than expertise.

Qualitative method allows one to use their judgement and subjective knowledge in forecasting. These techniques are based on models of mathematics and in nature are mostly objective. This type of forecasting relies upon the knowledge of highly experienced employees and consultants to provide insights into future outcomes.

Review of the Forecasting Process. Whether you are navigating your own business or trying to forecast the future of a specific product understanding quantitative forecasting can help you visualize future sales projections and. There are various methods of forecasting.

Quantitative forecasting techniques for sales include looking at census data for a geographic area reviewing historical seasonal sales reports and reviewing sales reports to see which products are maturing and showing recent slowdowns in sales and which products have recently begun selling at higher volumes.

The Ultimate Guide To Sales Forecasting Smartsheet

Quantitative And Qualitative Forecasting Techniques Om

Introductory Guide To Business Forecasting By Gaurav Chavan Towards Data Science

Forecasting Methods Definition Examples Top 6 Types

Quantitative And Qualitative Forecasting Techniques In Logistics Management

Posting Komentar untuk "What Are The Quantitative Forecasting Techniques Explain Each"