How To Calculate Three Period Moving Average Forecast

Hence the average age of the data in the forecast is m12. 11 12 13 14 240224204240 4 227 12 13 14 21 224204240244 4 228 13 14 21 22 204240244236 4 231 14 21 22 23 240244236220 4 235 21 22 23 24 244236220262 4 2405 22 23 24 31 236220262260 4 2445.

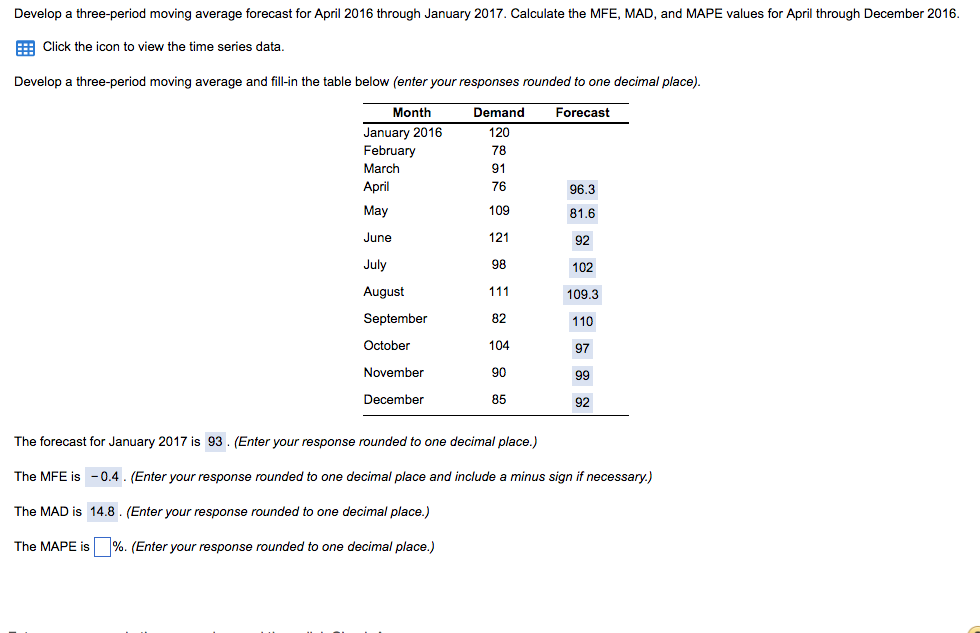

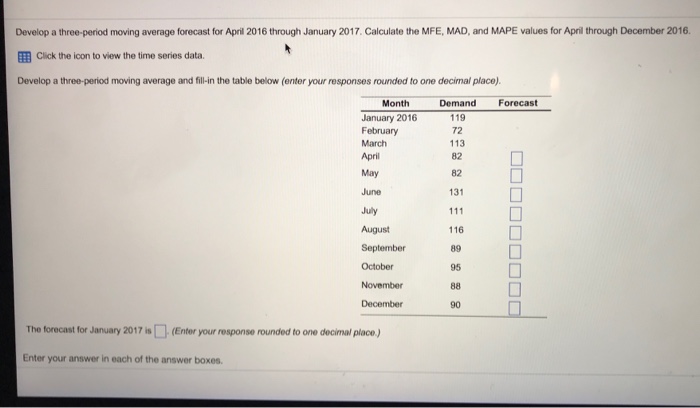

Solved Develop A Three Period Moving Average Forecast For Chegg Com

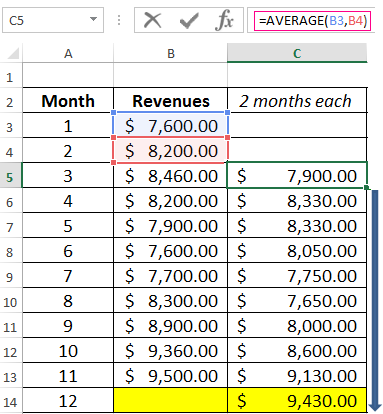

Next simply add the selected number of consecutive data points and divide by the number of periods.

How to calculate three period moving average forecast. 903 870 882 3 885. The 2 nd 3 point moving average is. To perform a moving average forecast the revenue data should be placed in the vertical column.

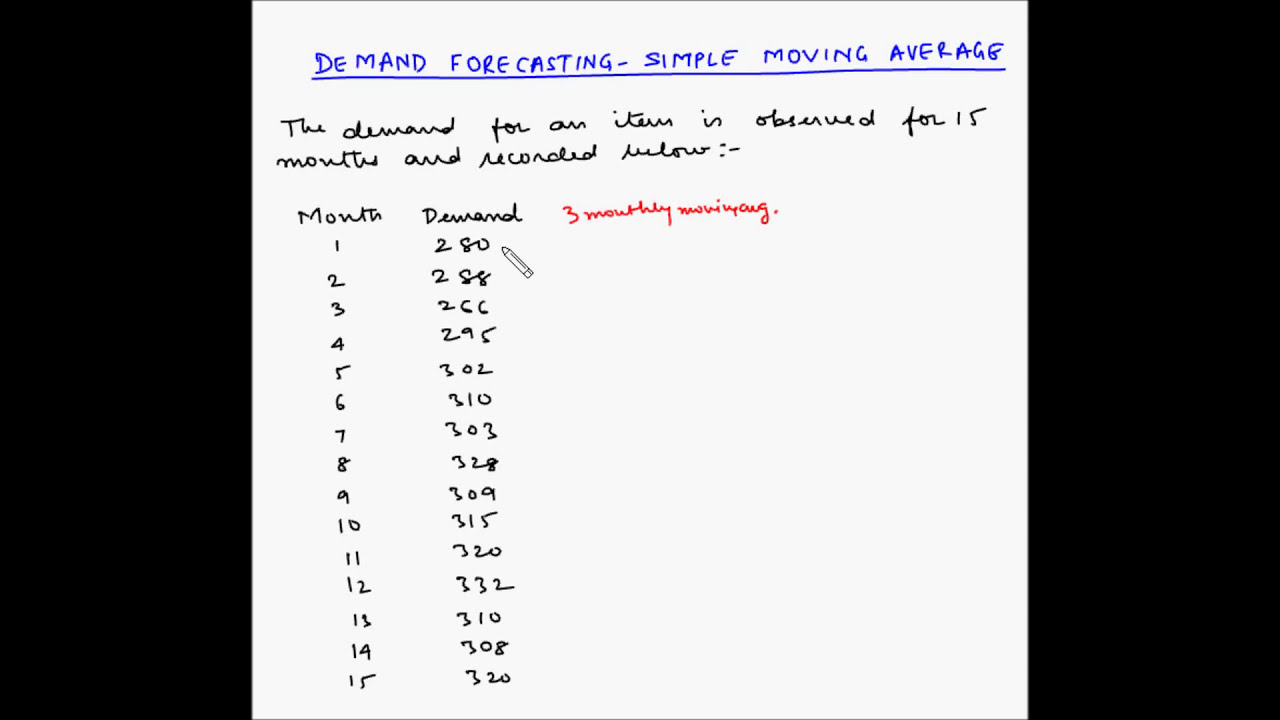

Q1 Q2 Q3 Q4 and then dividing by four. For example if we are computing 3-month Moving Averages MA we would use the following formula to estimate the data value during period n textForecast during period n hat Y_n displaystyle fracY_n-3 Y_n-2 Y_n-13. For example a simple moving average with a period of 10 will be calculated by adding up the closing prices of the last 10 bars and dividing the sum by 10.

870 882 810 3 854. Develop a three-period moving average forecast for periods 13-15 Period Demand 10 233 403 11 12 469 13 272 14 409 Calculate the forecasts for periods 13-15 by using a three-period moving average model enter your responses rounded to the nearest whole number Period Demand Forecast 10 233 403 11. Similarly we build a series of values for a three-month moving average.

The formula is next. Calculate all of the 3 point moving averages and describe the trend. The most common types are the 3-month and 5-month moving averages.

The Weighted Moving Average formula is similar to Method 4 Moving Average formula because it averages the previous months sales history to project the next months sales history. This is the amount by. Periods used YrQtr Moving Average.

The 3-month moving average is calculated by taking the average of the current and past two months revenues. The higher the value of n the smoother the moving average graph will be in comparison to a graph of the original data. By the same principle we form a series of values for the four-month moving average.

Firstly decide on the number of the period for the moving average such as 2-day moving average 5-day moving average etc. Stock analysts frequently examine the moving averages of stock prices to identify patterns and predict future movements. The moving average formula in Excel.

The 4 th 3 point moving average is. This is calculated by adding the latest four quarters of sales eg. When you are selecting a moving average period length you are deciding how far back to the history you want to look.

D Moving Average. Days M Data. Simple Moving Average Simple Moving Average Formula.

The 3 rd 3 point moving average is. Copy the formula to the range of cells C6C14 using the autocomplete marker. 3 rd day 113 4 th day 114 5 th day 115 6 th day 116 7 th day 117 5 115.

Solution of Simple Moving Average. Q4 Sales 27041 21018 28041 3 76100 3 25367. Example of Simple Moving Average.

Repeat the exercise to arrive at a set of averages. These final numbers 113 114 and 115 form the line that develops the SMA across the chart. Calculate the Simple moving average when time period is 3 and the closing prices are 25 85 65 45 95 75 15 35.

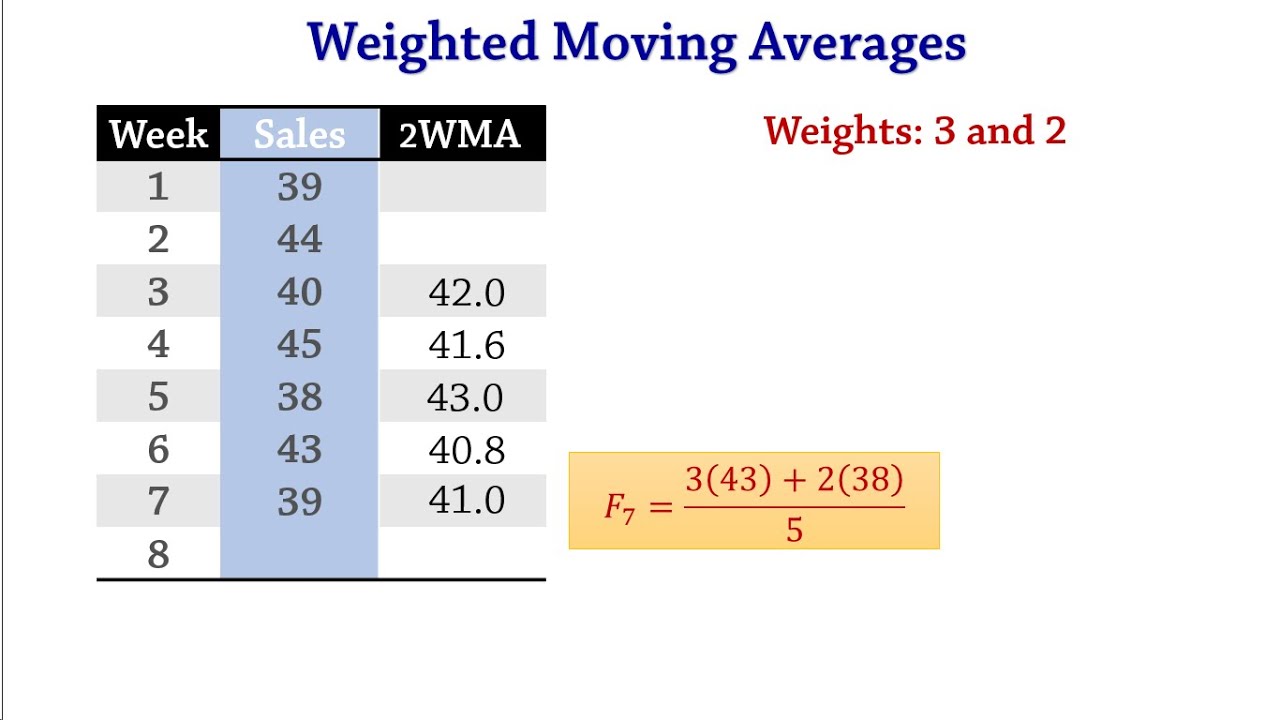

For example if we are computing 3-month weighted Moving Averages WMA with weights 6 3 and 2 we would use the following formula to estimate the data value during period n textForecast during period n F_n displaystyle frac6 times Y_n-3 3times Y_n-2 2times Y_n-1632. Operations Management questions and answers. The red line shows the quarterly moving average.

Simple Moving Average A 1 A 2 A n n. The first term in the average is 1 period old relative to the point in time for which the forecast is being calculated the 2nd term is two periods old and so on up to the mth term. Lets assume that we want to forecast the sales figure for the forth quarter of 2012 based on the sales of first three quarters of the year we will simply average the last three quarters sale.

1 st 3 point moving average. This technique smoothes out the quarterly variations and gives a good indication of the overall trend in quarterly sales. Calculation of SMA from 3 rd day to 8 th day in time period of 3 days.

936 939 903 3 926. In excel us will use formula. P n n.

If you would like to calculate the forecast for the coming period based on Simple Moving Average Method then formula F t n will be the sum of Actual Occurrence or Demands in the past period up to n periods divided by the number of periods to be averaged. 2 nd day 112 3 rd day 113 4 th day 114 5 th day 115 6 th day 116 5 114. However with this formula you can assign weights for each of the prior periods.

Create two columns 3-month moving averages and 5-month moving averages. SMA n P 1 P 2. 939 903 870 3 904.

Closing Prices 25 85 65 45 95 75 15 35 Time Period 3 days. Where F Forecast for the upcoming period. We based on the values of the initial time series.

Forecasting Weighted Moving Averages Mad Youtube

Solved Develop A Three Period Moving Average Forecast For Chegg Com

Calculation Of The Moving Average In Excel And Forecasting

Forecasting Simple Moving Average Example 1 Youtube

Solved Develop A Three Period Moving Average Forecast For Chegg Com

Posting Komentar untuk "How To Calculate Three Period Moving Average Forecast"