What Is The Forecast For May Using A Three-month Moving Average

Time Sequence Plot for X Simple moving average of 3 terms 0 20 40 60 80 100 120 100 300 500 700 900 X actual forecast Residual Autocorrelations for X 500 limits Simple moving average of 3 terms. Its the better way to make a forecast the trend of changing the companys revenue using the moving average method in Excel.

How To Use Moving Averages To Find The Trend Babypips Com

TCO 5 In May the actual product demand was 195 units.

What is the forecast for may using a three-month moving average. Forecast the revenue for May using a three-month moving average. 200 will often divert far from the price and stay away for extended periods of time. 38 What is the forecast for May using a four-month moving average.

Q4 Sales 27041 21018 28041 3 76100 3 25367. 36 Jan 40 Feb. Using exponential smoothing with an alpha of 03 determine the June forecast.

Using the same data assume the forecast for April was 8200. 50Johns House of Pancakes uses a weighted moving average method to forecast pancake sales. Operations Management questions and answers.

Based on this data forecast week 9 using a three-week moving average. Moving Average 780 - 108 672 to 888 With 889 accuracy the forecast demand for July using 3-mth Wt. Forecast week 8 with a three-period moving average and with a four-period moving average.

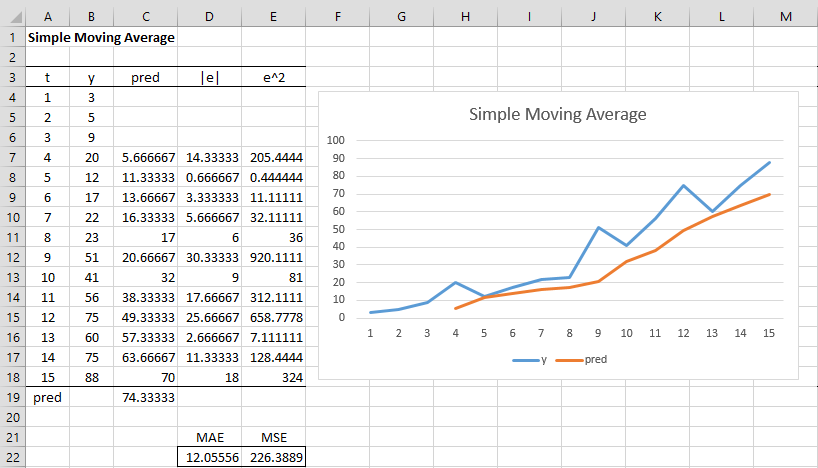

The forecasted revenue for 12 months is 9 430. The moving average length adjusts the amount of smoothing. 48 April 46 Select one.

Develop a three-period moving average forecast for periods 13-15 Period Demand 10 233 403 11 12 469 13 272 14 409 Calculate the forecasts for periods 13-15 by using a three-period moving average model enter your responses rounded to the nearest whole number Period Demand Forecast. If sales amounted to 1000 pancakes in May 2200 pancakes in June and 3000 pancakes in July what should be the forecast for August. Weight the most recent quarter 050 the second most recent 025 and the third 025.

Develop a forecast for the fourth quarter using a three-quarter weighted moving average. For example for monthly data a value of 3 indicates that the moving average for March is the average of the observations from March February and January. Using a four-month moving average determine the one-step-ahead forecasts for July through December 1999.

We have calculated the average of past three months sales ie. Next simply add the selected number of consecutive data points and divide by the number of periods. After comparing the tables with deviation it is preferable to use the model of a two-month.

Do the problem using quarters as opposed to forecasting separate months. It assigns a weight of 5 to the previous months demand 3 to demand two months ago and 1 to demand three months ago. In any case residual autocorrelations are not the bottom line just a red flag that may wave to indicate that there may be a better model out there somewhere.

For this month 200 units had been forecasted. Compute MAD MSE MAPE for the forecasts obtained in b. 4073 Time-series forecasting easy Weekly sales of copy paper at Cubicle Suppliers are in the table below.

Forecast for December using 3-month SMA method. Lets assume that we want to forecast the sales figure for the forth quarter of 2012 based on the sales of first three quarters of the year we will simply average the last three quarters sale. What is the forecast for May using a four-month moving average.

Round your answer to 2. M 3 10 12 133 1167 m 4 12 13 173 1400 m 5 13 17 153 1500 m 6 17 15 193 1700 m 7 15 19 203 1800 m 8 19 20 213 2000 m 9 20 21 203 2033. On the contrary a long period moving average eg.

Firstly decide on the number of the period for the moving average such as 2-day moving average 5-day moving average etc. For a simple 3-month moving average we take the average of the previous three months demand as our forecast for next month. This lag happens because the price needed to produce the moving average has already happened.

Johns House of Pancakes uses a weighted moving average method to forecast pancake sales. It assigns a weight of 5 to the previous months demand 3 to demand two months ago and 1 to demand three months ago. Accounting questions and answers.

Again on day 7 the price is 117 and the moving average is 115. In excel us will use formula. Sales of November October and September.

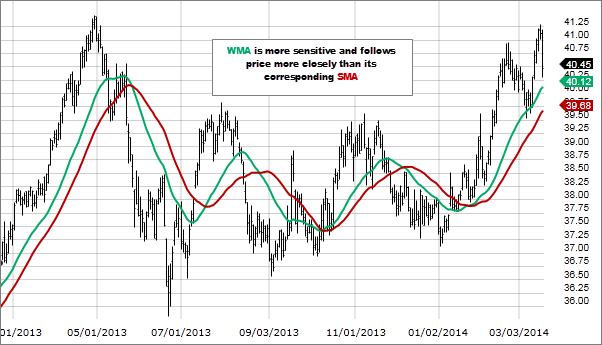

You will notice that the long moving average lags behind the price it always goes in the same direction as the. Ft1 Dt Dt1 Dt2 3. If sales amounted to 1000 pancakes in May 2200 pancakes in June and 3000 pancakes in July what should be the forecast for August.

Moving Average 780- 2108 564 to 996 Exercise. Notice that the moving average lags behind the price in this equation. It has minimal errors in forecasting in comparison with three and four-month.

48 April 46 Select one. 36 Jan 40 Feb. With 57 accuracy the forecast demand for July using 3-mth Wt.

Pg471 Problem 3 11. Using a three month weighted moving average compute a forecast for June with weights of 01 03 and 06 oldest data to newest data. The moving average length is the number of consecutive observations that Minitab uses to calculate the moving averages.

The three month moving average for months 3 to 9 is given by. Repeat the exercise to arrive at a set of averages. A short period moving average eg.

Since we need at least three months to compute the average and we only have data beginning in January April is the earliest month for which we can compute the forecast. The past 5-month sales value from July to November are 164 173 168 174 169 See the above table. On day 6 the price was 116 and the moving average is 114.

For example if we are computing 3-month Moving Averages MA we would use the following formula to estimate the data value during period n textForecast during period n hat Y_n displaystyle fracY_n-3 Y_n-2 Y_n-13. 10 will track the price closely almost all the time. 169 174 1683 17033.

3 of 3 Comments. If FunkyTunes uses a smoothing constant of 06 what would be the. On day 5 with a price of 115 the moving average is 113.

Determine the one-step-ahead forecasts for the demand for January 2000 using 3- 6- and 12-month moving averages. Simple Moving Average A 1 A 2 A n n.

Simple Moving Average Real Statistics Using Excel

How To Use Moving Averages To Find The Trend Babypips Com

Moving Average Ma Explained For Traders

:max_bytes(150000):strip_icc()/dotdash_INV-final-Double-Exponential-Moving-Average-DEMA-May-2021-01-8d42622fd8be4a208625351be393826d.jpg)

Double Exponential Moving Average Dema Definition And Calculation

200 Day Moving Average What It Is And How It Works

Posting Komentar untuk "What Is The Forecast For May Using A Three-month Moving Average"